21 October 2014

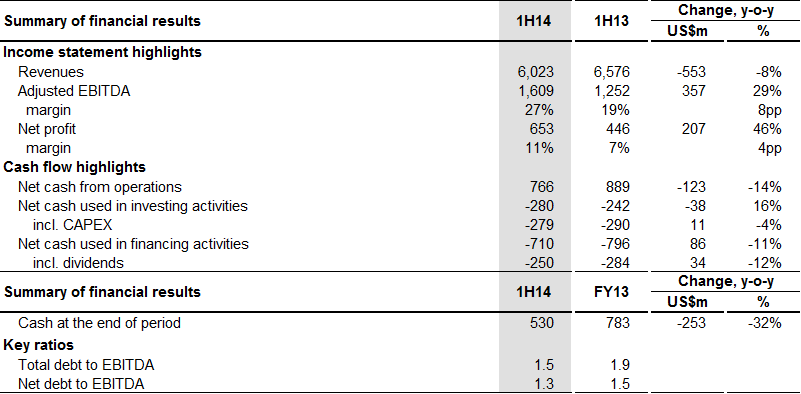

21 October 2014 – Metinvest B.V., the parent company of a vertically integrated group of steel and mining companies (jointly referred to as “Metinvest” or “the Group”), today announced its unaudited IFRS interim condensed consolidated financial statements for the first six months ended 30 June 2014.

21 October 2014 – Metinvest B.V., the parent company of a vertically integrated group of steel and mining companies (jointly referred to as “Metinvest” or “the Group”), today announced its unaudited IFRS interim condensed consolidated financial statements for the first six months ended 30 June 2014.

Notes:

1) Adjusted EBITDA is calculated as earnings before income tax, financial income and costs, depreciation and amortisation, impairment and devaluation of property, plant and equipment, sponsorship and other charity payments, the share of results of associates and other non-core expenses. Adjusted EBITDA will be referred to as EBITDA throughout this release.

2) Net debt is calculated as the sum of long-term and short-term loans and borrowings and seller notes less cash and cash equivalents.

OPERATIONAL AND CSR HIGHLIGHTS

- The Group began rebuilding Blast Furnace No. 4 at Azovstal. When completed, the modernised furnace will ultimately produce an additional 1.5 million tonnes of hot metal a year, while cutting dust emissions by 340 tonnes annually.

- Yenakiieve Steel completed the overhaul of its basic oxygen furnace, improving efficiency and reliability, while reducing environmental impact. The work was completed ahead of schedule.

- Metinvest-SMC opened a new retail warehouse for steel products in Kharkiv.

- Metinvest launched its 2014 “We Improve the City” social investment competition in nine cities in the Donetsk, Dnipropetrovsk and Luhansk regions. The annual competition allows local stakeholders to select and obtain funding for projects that promise to make the greatest difference to the lives of local residents.

- Metinvest continued to invest in upgrading healthcare facilities in Mariupol, including by opening a new clinic and funding existing hospitals. The Group has sponsored the upgrades of 16 hospitals, clinics and maternity homes in Mariupol since 2011.

CORPORATE STRUCTURE HIGHLIGHTS

- In February, MetalUkr Holding Limited (Cyprus), a wholly owned subsidiary of Metinvest B.V., transferred 78.31% of Northern GOK, 99.48% of Central GOK, 0.25% of Azovstal and 1.21% of Khartsyzk Pipe to Metinvest B.V. to help the Group to reach its intended structure and improve business transparency and management efficiency.

- From March to June 2014, the Group paid US$15 million for 36% in Black Iron (Cyprus) Limited, which owns licences to develop two iron ore deposits near Kryvyi Rih, Ukraine.

KEY EVENTS AFTER THE REPORTING PERIOD

- In July, the Group entered into numerous transactions with Smart Holding to acquire an effective interest of 46% in Yuzhniy GOK and non-controlling interests of 16.1% in Northern GOK and 14.1% in Ingulets GOK.

- In July 2014, SCM and Smart Holding announced the completion of the merger of their metals and mining assets into the jointly managed Metinvest B.V. The two parties signed a shareholder agreement outlining the relevant and proportional corporate governance rights of each in Metinvest B.V. In addition, to conclude the transaction, Metinvest B.V. issued an additional share in favour of Smart Holding. As a result, SCM’s stake in Metinvest B.V. will be 71.24%, Smart Holding will own 23.76%, and Clarendale Limited (affiliated with the former owners of Ilyich Steel) will retain 5%.

- Also in July, the Group opened a new sales office in Romania, while Metinvest-SMC, the Group’s retail entity in Ukraine, opened new retail warehouses in Kyiv Region and Mykolaiv.

- In the third quarter of 2014, the Group was affected by the conflicts in parts of the Donetsk and Luhansk regions. In particular, the Group has experienced periodic interruptions in its production and supply chains, mainly as a result of logistical and electricity-related issues in the regions. These resulted in temporary suspensions or reduced volumes of production, beginning in the second half of August and continuing to the present. We expect the resolution of the conflict to lead to a restoration of normal production levels.

- In addition, in September, the area of conflict expanded towards the southeastern part of the Donetsk region, up to around 20 kilometres east of Mariupol, where two of the Group’s key steel plants are located. They remain fully operational, but subject to raw material logistical constraints.

- In July, the Group increased its share in Black Iron (Cyprus) Limited to 49% by paying an additional US$5 million, bringing its total investment to US$20 million. Black Iron (Cyprus) Limited and Metinvest retain an option to participate in the developing the Shymanivske iron ore project, representing a potential future investment of up to US$536 million for the Group.

Yuriy Ryzhenkov, Chief Executive Officer of Metinvest, commenting on the results, said: “In the first half of 2014, the economic and political situation in Ukraine continued to pose challenges.

Moody’s Investor Service downgraded Ukraine’s sovereign rating twice in the period: from Caa1 to Caa2 in January and to Caa3 with a negative outlook in April. In addition, from January to April, the Ukrainian hryvnya slid by around 50% compared with the main international currencies. In April, the civil and political instability in parts of Eastern Ukraine – notably some areas in the Donetsk and Luhansk regions, where some of our assets are located – escalated considerably.

Since the end of the reporting period, we have faced ongoing and significant operational risks due to the conflict, particularly in some parts of Donetsk and Luhansk regions, where the situation worsened considerably in July and August. As we have reported, Avdiivka Coke was directly affected by damage to property and electricity transmission lines in July. Employees from the plant and the DTEK power company acted quickly to bring Avdiivka Coke back online to meet the minimum needs of our steelmaking facilities, and production is gradually returning to normal. In mid-August, Yenakiieve Steel temporarily halted its main operations due to damage, and repair works are under way. Operations at Khartsyzk Pipe have been temporarily halted due to damage to railway infrastructure and will recommence once it has been repaired. Production at Krasnodon Coal's mines has been scaled back, also due to damage to railway infrastructure, and will be restored following the necessary repairs. In addition, Azovstal and Ilyich Steel are currently operating at around 50-60% of capacity due to raw material logistical constraints. Throughout Eastern Ukraine, utilisation rates of steel, coal and coke production facilities have fallen.

Given the disruptions to some key sections of our railway network and stations, to maintain the flow of raw materials to our plants and finished goods to customers, our logistics unit has set up a crisis centre in cooperation with Ukrainian Railways and its regional subsidiaries. We are also looking at alternatives, such as seaborne deliveries.

In the event of power cuts or other emergencies posing a threat to our employees, operations or surrounding environment, we have prepared for the potential evacuation of key facilities in the region. While we believe that we have taken appropriate measures to protect our employees and, as far as possible, our assets and supply chain, the situation remains unpredictable. We will continue to provide updates for all of our stakeholders as the situation develops.

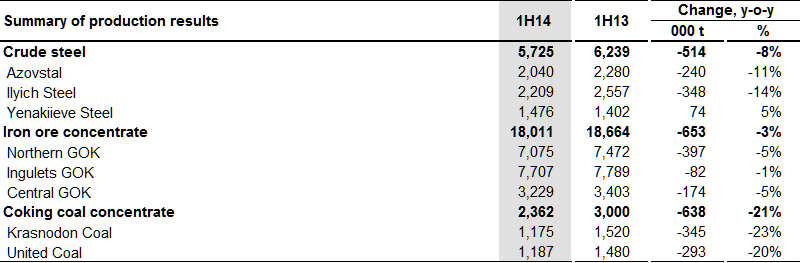

In the first half of 2014, revenues declined by 8% year-on-year, primarily driven by declining prices and demand for iron ore products, as well as a drop in sales of steel products affected by lower crude steel production. In addition, the disruptions to our operational performance were minimal. Compared with the first half of 2013, crude steel output fell by 8% to 5,725 thousand tonnes, iron ore concentrate by 3% to 18,011 thousand tonnes and coking coal concentrate by 21% to 2,362 thousand tonnes.

We increased CAPEX by 8% year-on-year to US$272 million in the first half of 2014 as we continued the long-term investments detailed in our Technological Strategy, reflecting our commitment to our strategic vision of building a leading vertically integrated European steelmaker.

Major CAPEX projects in our Metallurgical division included the construction of the PCI facilities at Yenakiieve Steel and Azovstal to boost the efficiency of steel production, construction of a standby turbine air blower at Yenakiieve Steel and replacement of a turbine air blower at Azovstal. In addition, Metinvest continued building the infrastructure for a new air separation unit at Yenakiieve Steel. In the Mining division, we continued installing a crusher and conveyor system at Northern GOK and Ingulets GOK as well as rebuilding the pelletising machines at Northern GOK.

After the reporting period, in July 2014, our two major shareholders, SCM and Smart Holding, completed the merger of their metals and mining assets into Metinvest B.V., which they jointly manage. This streamlines our corporate governance structure; Smart Holding now has three of the 10 seats on our Supervisory Board.

We will continue to keep our investors, customers and other stakeholders informed regarding any disruption to our operations caused by the current conflict. As Ukraine’s largest company, we consider it vital to maintain continuity during this difficult period and be positioned to contribute to economic recovery when the conflict is resolved.”

Commenting on the results, Aleksey Kutepov, Chief Financial Officer of Metinvest, said: “We delivered a solid financial performance in the first six months of 2014, despite challenges ranging from transportation bottlenecks due to adverse weather in the first quarter to a sustained deterioration in the domestic economic climate due to the geopolitical situation in Eastern Ukraine. At this stage, we cannot predict whether there is potential for further disruption, so any potential impact on our full-year performance is unclear.

Regarding the broader market context, the world steel market remains challenging and reflects a mixed global economic situation. While developed economies, including the Euro area and the US, continue to recover, China’s growth rate remains well below pre-crisis levels, as the authorities there have pursued tighter monetary policies. The World Bank estimates that growth in emerging markets will remain below 5% in 2014.

Despite the challenging conditions, Metinvest maintained a stable top line and significantly enhanced EBITDA and net profit, which rose by 29% and 46% year-on-year, respectively, in 1H 2014. The devaluation of the hryvnya and the consequent positive foreign-exchange effect was a key factor in the 29% increase in EBITDA and 46% increase in net profit, with respective margins increasing by 8 and 4 percentage points. While the Metallurgical division’s EBITDA remained positive, the Mining division’s remained the primary contributor in absolute terms.

Part of the reason for this was our ability to divert products among key markets easily. Amid a decline in steel consumption and market capacity in Ukraine and the ruble devaluation in Russia, we re-oriented sales from those markets to the Euro area and the Middle East and North Africa. In addition, in Russia itself, we reduced sales volumes selectively, concentrating on more profitable and closer regions to retain market share.

We continued to focus on streamlining the business by optimising distribution, general and administrative expenses as part of strategic steps to cut costs. Lower raw materials and natural gas costs and foreign-exchange effects contributed to a 20% reduction in the cost of sales.

Against a background of market turbulence and a deteriorating environment for Ukrainian borrowers following two downgrades of the sovereign rating by Moody’s Investor Service, we reduced total and net debt further, by 10% and 5% respectively. This was mainly due to less use of trade finance lines and the scheduled amortisation of bank loans. We also increased CAPEX by 8%, as we continued to invest in our plants to improve efficiency and reduce our environmental footprint.”

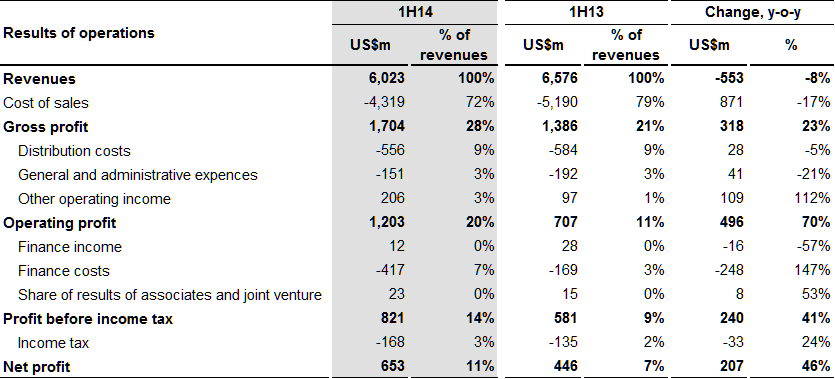

RESULTS OF OPERATIONS

Revenues

Metinvest’s revenues are generated from sales of its steel, iron ore and coal and coke products and re-sales of products from third parties. Unless otherwise stated, revenues from sales to third parties exclude any intragroup transfers. Revenues are reported net of VAT, excise taxes and export duties and include the cost of transporting products to customers.

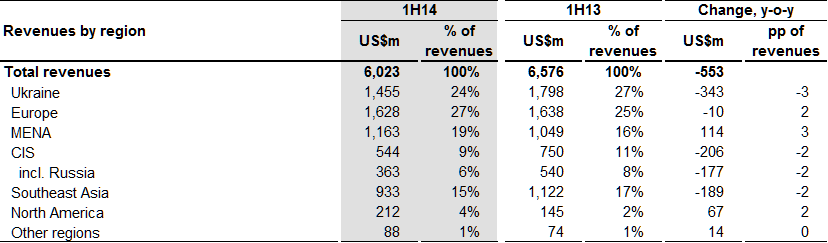

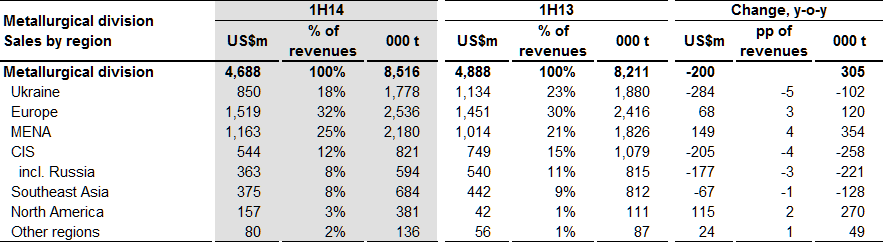

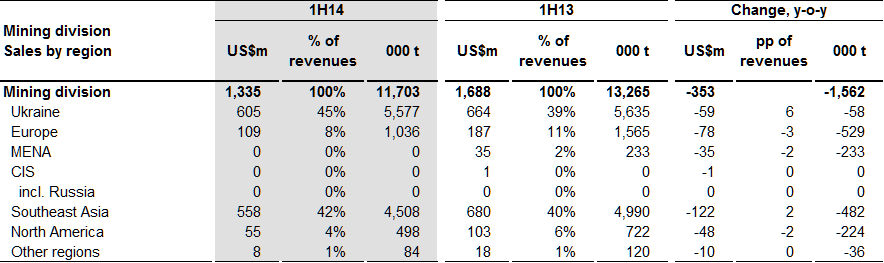

In 1H 2014, Metinvest's consolidated revenues fell by US$553 million y-o-y to US$6,023 million. Revenues from the Mining division declined by US$353 million, while those from the Metallurgical division dropped by US$200 million, mainly due to a slump in volumes of finished steel and volumes and prices of iron ore concentrate. The Metallurgical division accounted for 78% of external sales (74% in 1H 2013) and the Mining division for 22% (26% in 1H 2013).

In 1H 2014, Metinvest’s revenues from Ukraine decreased by US$343 million y-o-y to US$1,455 million which accounted for 24% of consolidated revenues. The decline of total sales in domestic market was primarily due to lower market capacity driven by the major steel consuming sectors. Steel production in Ukraine decreased by 6.9% y-o-y to 15.5 million tonnes in 1H 2014, as the domestic steel market remained weak and demand for Ukrainian steel products declined in Russia. In addition, consumption of steel products (excluding pipes) in Ukraine decreased by 18.9% y-o-y to 2.9 million tonnes. The main factor was a decline in construction activity, which fell by 8.9% y-o-y as Ukrainian businesses reduced capital expenditures because of financial instability and the tension in the east of the country. Another contributing factor was a crisis in domestic railcar manufacturing, which decreased by 77.1% y-o-y to 3.5 thousand units, while Ukrainian railcar producers have limited to the Russian market. The pipe and hardware industries reduced production by 15.2% y-o-y and 14.6% y-o-y respectively. Manufacturing output declined by 9.4% y-o-y.

Global crude steel production increased by 2.4% y-o-y to 820 million tonnes in 1H 2014, as key consuming industries in various regions recovered. China continued to be the main driver of growth. In 1H 2014, Chinese companies increased crude steel production by 9.9 million tonnes y-o-y, more than half of the global increase in absolute terms. China expanded its exports, while the domestic market stagnated. The highest growth in relative terms was in the Middle East (up 9.5% y-o-y) and Europe (up 3.8% y-o-y). In terms of capacity, the average monthly world capacity utilisation rate in 1H 2014 was broadly flat at 78% (down 0.8% y-o-y).

Global iron ore production increased by 1.9% y-o-y to 966 million tonnes in 1H 2014. The growth was driven by the growing capacity of the "Big Four" mining firms, as well as greater supplies from Australia and Brazil. Global consumption rose by 3.3% y-o-y to 969 million tonnes. The price of iron ore, which has been falling since the end of 2013, averaged US$112 per tonne in 1H 2014, down 19% y-o-y. This slump was primarily due to the increase in the “Big Four’s” production capacity over the reporting period.

Amid the drop in domestic sales, the share of international sales increased by 3 pp y-o-y to 76% in 1H 2014. Europe’s share rose by 2 pp y-o-y to 27% due to greater sales of semi-finished and long products. The share of sales to the Middle East and North Africa (MENA) rose by 3 pp y-o-y to 19%, driven by higher volumes of semi-finished and flat products. The share of sales to the Commonwealth of Independent States (CIS, excluding Ukraine), mainly Russia, fell by 2 pp y-o-y to 9% as a results of the redirection of finished steel volumes to other key markets due to ruble devaluation in 1Q 2014, which was not compensated by corresponding price increases in US dollar equivalent. The share of sales to Southeast Asia dropped by 2 pp y-o-y to 15% amid a decline in volumes of iron ore concentrate and semi-finished steel products. The share of sales to North America rose by 2 pp y-o-y to 4% due to greater sales of pig iron y-o-y.

Metallurgical division

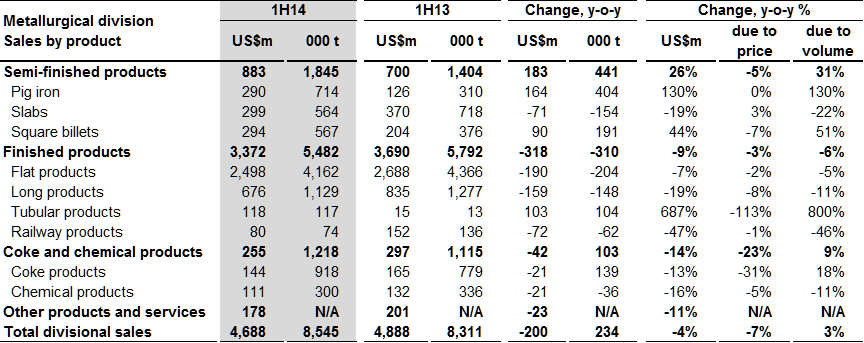

The Metallurgical division generates revenues from sales of pig iron, steel and coke products and services. In 1H 2014, its revenues decreased by US$200 million y-o-y to US$4,688 million that was attributable to lower sales of flat products by US$190 million, long products by US$159 million, railway products by US$72 million and slabs by US$71 million. At the same time, revenues were largely compensated by increases in sales of pig iron by US$164 million, square billets by US$90 million and tubular products by US$103 million, primarily driven by higher volumes.

In 1H 2014, sales of pig iron increased by US$164 million y-o-y to US$290 million, up 130% y-o-y, driven solely by sales volumes, which increased by 404 thousand tonnes. The effective average selling price remained unchanged y-o-y. Sales surged due to a stronger market for pig iron versus steel products and higher relative production volumes. The main regional driver was North America, where sales rose by 282 thousand tonnes y-o-y, or 70% of the overall sales growth. Other notable areas were MENA and Europe, which accounted for 23% and 11% of the growth in pig iron sales, and where volumes increased by 92 thousand tonnes and 45 thousand tonnes, respectively.

In 1H 2014, sales of slabs decreased by US$71 million y-o-y to US$299 million. While the effective average selling price was marginally higher, sales volumes decreased by 154 thousand tonnes y-o-y to 564 thousand tonnes, down 22%, mainly due to lower crude steel production in 1H 2014, caused by adverse weather conditions in 1Q 2014 and the maintenance of the blast furnace at Azovstal in March 2014, which resulted in a decline in slab production of 77 thousand tonnes y-o-y. On the backdrop of lower sales volumes, a geographical structure of sales was improved in terms of increasing volumes to more profitable MENA (mainly Turkey) market by reducing sales to Southeast Asia. In addition, sales volumes to the European market decreased by 66 thousand tonnes y-o-y following a slump in capacity on the region’s slab market. The effective average slab selling price grew by 3% y-o-y, in line with FOB Black Sea market rates.

In 1H 2014, sales of square billets increased by US$90 million y-o-y to US$294 million. Despite a lower effective average selling price, volumes increased by 191 thousand tonnes y-o-y to 567 thousand tonnes, up 51%, mainly due to greater sales volumes in MENA, which increased by 180 thousand tonnes y-o-y. This was primarily attributable to a decline in demand for wire rod and debar and the consequent higher sales of square billets. Turkey (40% of total billet sales volumes), Egypt, Tunisia, Libya, Jordan and the United Arab Emirates were among the key markets where Metinvest managed to increase sales by concluding direct contacts with end customers. The effective average selling price declined by 7% y-o-y in line with FOB Black Sea market rates.

In 1H 2014, sales of flat products decreased by US$190 million y-o-y to US$2,498 million due to a 5% decline in sales volumes and a marginally lower effective average selling price. Flat product volumes dropped by 204 thousand tonnes y-o-y to 4,162 thousand tonnes, driven by a decline in output of plate at Azovstal (95 thousand tonnes) and coil at Ilyich Steel (129 thousand tonnes). On the backdrop of lower sales volumes in Ukraine and Russia, sales were redirected to MENA and Southeast Asia. Sales volumes in Ukraine dropped by 170 thousand tonnes y-o-y, as consumption of steel products slumped by 19% y-o-y, mainly in construction (down 8.9% y-o-y), railcar manufacturing (down 77.1% y-o-y), and manufacturing (down 9.4% y-o-y), while the domestic market shrank due to the political tensions and economic contraction in Ukraine. Sales volumes to Southeast Asia and MENA rose by 61 thousand tonnes and 28 thousand tonnes y-o-y, respectively. This was driven by the redirection of Zaporizhstal’s plates and coils from the less attractive Russian market due to the ruble devaluation in 1Q 2014, which was not compensated by corresponding price increases in US dollar equivalent to end customers in Turkey and Egypt, and new customers in Israel, India and Pakistan. Despite this, Metinvest selectively reduced sales volumes in Russia, concentrating on more profitable and closer regions to retain market share. In line with FOB Black Sea market prices for hot-rolled coil, the effective average selling price fell by 2% y-o-y. This was mostly associated with a y-o-y fall in prices for basic raw materials, namely iron ore, coking coal and scrap.

In 1H 2014, sales of long products decreased by US$159 million y-o-y to US$676 million, as sales volumes declined by 11% and the average effective average selling price by 8%. Sales volumes of long products fell by 148 thousand tonnes y-o-y, caused by drop in sales volumes in Russia and Ukraine. Sales volumes to Russia declined by 116 thousand tonnes, mainly due to lower demand for long products and the ruble devaluation, which was not compensated by corresponding prices increases in US dollar equivalent. Metinvest selectively reduced sales volumes in Russia, concentrating on more profitable and closer regions. Sales volumes in Ukraine declined by 84 thousand tonnes y-o-y, amid an overall decrease in demand for rolled steel, due to the political tensions and economic contraction. Metinvest’s share of domestic sales volumes of wire rod and bars rose by 3-4 pp, while its share of domestic debar sales marginally declined amid greater competition with local producers. These factors were partly compensated by positive dynamics in Europe, where sales of long products rose by 88 thousand tonnes y-o-y, as debar sales from Promet Steel increased following improvements in client service (flexible shipping schedule, shipment by road) and supplies to new projects in Bulgaria, as well as to new clients in Romania. The effective average selling price dropped by 8% following the y-o-y fall in prices for basic raw materials, namely iron ore, coking coal and scrap.

In 1H 2014, sales of railway products decreased by US$72 million y-o-y to US$80 million amid a 46% decline in sales volumes following a slump in production and a marginally lower effective average selling price. Sales volumes of rails declined by 78 thousand tonnes y-o-y in CIS countries, mainly due to the termination of railway product sales in Kazakhstan in 2014 ahead of the introduction of new technical specifications for rails in line with Customs Union standards. The potential for producing rails according to those specifications is under review. The decrease in CIS sales volumes was also attributable to a reduction in financing by the Belarus government for railway projects in the country. Despite this, export sales of rails to Europe increased by 19 thousand tonnes y-o-y mainly due to an increase in sales volumes to Bulgaria.

In 1H 2014, sales of tubular products increased by US$103 million y-o-y to US$118 million, driven by a surge in sales volumes while effective average selling price decreased. Sales volumes of tubular products increased by 104 thousand tonnes y-o-y to 117 thousand tonnes, mainly due to a rise in CIS sales volumes, which grew by 97 thousand tonnes and accounted for almost 93% of tubular sales volumes. The rise in CIS sales volumes was attributable to shipments for the second phase of the East-West pipeline project (Turkmenistan) and the second phase of the Beineu-Shymkent project (Kazakhstan).

In 1H 2014, sales of coke and chemical products decreased by US$42 million y-o-y to US$255 million amid a 23% slump in the effective average selling price of coke products, whose effect was offset by higher sales volumes. Sales volumes of coke products increased by 139 thousand tonnes y-o-y to 918 thousand tonnes, mainly due to higher sales volumes of coke breeze and coke in Ukraine, which was attributable to a shift in volumes from internal consumption to external sales. The effective average selling price declined by 23% y-o-y due to coal prices declining and the share of less expensive coke breeze in total coke and chemical product volumes increasing to 28%, up from 19% in 1H 2013.

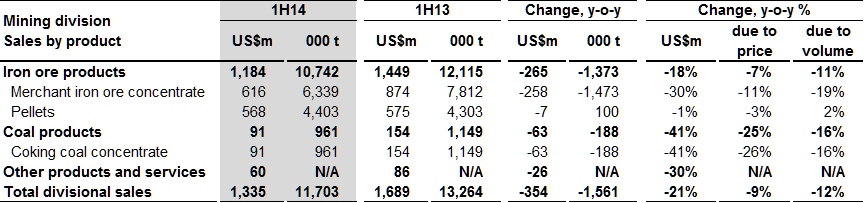

Mining division

The Mining division generates revenues from sales of iron ore, coal and other products and services. In 1H 2014, its revenues decreased by US$353 million y-o-y to US$1,335 million. Revenues from iron ore fell by US$258 million and coking coal concentrate by US$63 million, while sales volumes of pellets increased marginally, keeping pellets sales broadly flat y-o-y.

In 1H 2014, merchant iron ore concentrate sales declined by 30% y-o-y to US$616 million amid a 19% drop in sales volumes and an 11% decline in the effective average selling price. Sales volumes decreased by 1,473 thousand tonnes y-o-y to 6,339 thousand tonnes, driven by a decline in merchant iron ore concentrate production volumes due to the adverse weather conditions in January-February 2014 and adjustments to the internal iron ore product consumption mix. This mainly affected sales volumes in Southeast Asia, which dropped by 1,230 thousand tonnes y-o-y and in Europe by 244 thousand tonnes. The effective average selling price decreased by 11% y-o-y, following Platt’s 62% Fe iron ore fines CFR China spot benchmark, which dropped by 19% y-o-y. Prices averaged US$112 per tonne, compared with US$138 per tonne in 1H 2013. The effective average selling price in Southeast Asia fell by 18% y-o-y, in line with the Platt’s benchmark. The effective average selling price in Europe fell by a more moderate 11% y-o-y, as operational improvements were made, contracts with a premium to Platt’s were concluded, and the effect from linking contracts to Platt’s 65% Fe rate was felt. The effective average selling price in Ukraine dropped by 4% y-o-y, much less than the Platt’s benchmark, due to changes in the concentrate sales mix and fluctuations in Platt’s quotations in the previous quarters of 2014 and 2013, respectively.

In 1H 2014, pellet sales marginally decreased by US$7 million y-o-y to US$568 million, as the effective average selling price dropped by 3% partially compensated by an increase in sales volumes by 2%. Despite a broadly stable sales volumes y-o-y, the company changed geography of sales by redirecting volumes from Europe (252 thousand tonnes) and Turkey (233 thousand tonnes) to Southeast Asia (747 thousand tonnes) due to more attractive prices there. In addition, sales volumes to Ukraine decreased by 162 thousand tonnes as Metinvest increased internal consumption. The effective average selling price in Southeast Asia dropped by 7% y-o-y, as Platt’s quotations fell by 19% y-o-y; the effect was partly offset by operational improvements and a positive effect from signing contracts with a premium higher than the market average. In Ukraine, the effective average selling price dipped by 1% y-o-y primarily due to the beneficial effect from a change in the pricing formula. The overall effective average selling price dropped by 3% y-o-y, much less than Platt’s. This was driven mainly by rise in the share of sales to Southeast Asia, where prices are relatively higher compared with other markets: its share reached 59% in 1H 2014, up from 44% a year earlier.

In 1H 2014, sales of coking coal concentrate dropped by US$63 million y-o-y to US$91 million amid a 16% decline in sales volumes and a 25% decrease in the effective average selling price. Sales volumes declined by 189 thousand tonnes y-o-y to 961 thousand tonnes, mainly due to a fall in production volumes and a subsequent drop in sales, largely in North America. The effective average selling price fell by 25% y-o-y, primarily as a result of the global price trend: in 1H 2014, the average spot price of hard coking coal FOB Australia dropped by 24% y-o-y.

Cost of sales

Metinvest’s cost of sales consists primarily of the cost of raw materials, the cost of energy materials, including gas and electricity; payroll and related expenses for employees; amortisation and depreciation; repair and maintenance expenses; outsourcing; taxes; and other costs.

In 1H 2014, Metinvest’s consolidated cost of sales declined by US$871 million y-o-y to US$4,319 million. The decrease was primarily driven by (i) favourable movements in the UAH/USD exchange rate, which accounted for US$572 million; (ii) change in work-in-process and finished goods balances amounting to US$348 million that was caused by sales exceeding production in 1H 2013, due to shipments of iron ore materials from stock and the favourable situation on the European market, compared with lower sales than production in 1H 2014 due to the unfavourable situation on the Ukrainian and Russian markets; (iii) lower prices and consumption volumes of key raw materials, which saved US$86 million and US$12 million, respectively; (iv) a reduction in natural gas consumption (US$38 million) and favourable gas price fluctuations (US$54 million). These factors were partly offset by (i) an increase of US$103 million in goods for resale, mainly from Zaporizhstal; (ii) an increase of US$39 million in electricity costs due to greater consumption and higher electricity tariffs in 1H 2014; (iii) an increase in wages and salaries by US$72 million in 2Q 2014. As a percentage of consolidated revenues, cost of sales equalled 72% in 1H 2014, down from 79% a year earlier.

Distribution costs

Distribution costs consist largely of transportation costs, salaries paid to sales and distribution employees, and commissions paid by Metinvest’s European subsidiaries to third-party sales agents and trade offices for their services and costs of materials. In 1H 2014, distribution costs decreased by US$28 million y-o-y to US$556 million, mainly due to a decline in transportation expenses of US$26 million. That drop was attributable to positive movements in the UAH/USD exchange rate (US$37 million), partly offset by an increase in loading and trucking costs following a change in Metinvest’s sales geography and breakdown (US$11 million). As a percentage of consolidated revenues, distribution costs remained unchanged y-o-y at 9% in 1H 2014.

General and administrative costs

General and administrative costs consist largely of salaries paid to administrative employees; consultancy fees; audit, legal and banking services expenses; insurance costs; and lease payments. In 1H 2014, general and administrative costs decreased by US$41 million to US$151 million. This was mainly due to positive movements in the UAH/USD exchange rate (US$33 million) and a fall in other expenses arising from a reduction in purchases of goods and services (consulting, audit and legal) by the head office (US$11 million), partly offset by an increase in wages and salaries in 2Q 2014 (US$6 million). As a percentage of consolidated revenues, general and administrative costs remained unchanged y-o-y at 3% in 1H 2014.

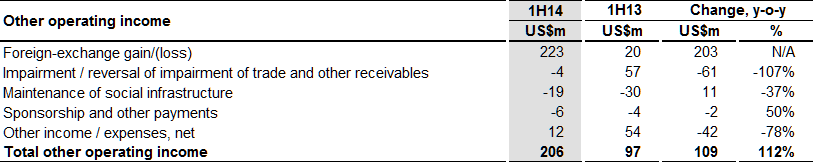

Other operating income/expenses

Other operating income and expenses consist primarily of sponsorship and other charity expenses, foreign exchange gains less losses, maintenance of social infrastructure, gains or losses on disposals of property, plant and equipment, and gains or losses on sales of inventory.

In 1H 2014, other operating income increased by US$109 million to US$206 million, driven by positive movements in the UAH/USD exchange rate that resulted in net foreign exchange gains of US$203 million, mainly due to the recalculation of trade receivables and payables at the reporting date. This was offset by a change in impairment of trade and other receivables (US$61 million) and a decrease in other income (US$39 million), which represented fines paid by customers for overdue trade and other receivables. As a percentage of consolidated revenues, other operating income stood at 3% in 1H 2014, up from 1% a year earlier.

Operating profit

In 1H 2014, operating profit increased by US$496 million y-o-y to US$1,203 million, equalling a corresponding margin of 20%, up 9 pp y-o-y. The rise in operating profit primarily reflects the fall in the cost of sales of US$871 million due to favourable movements in the UAH/USD exchange rate and lower prices of key raw materials and natural gas; an increase in other operating income of US$109 million, primarily caused by non-cash net foreign exchange gains (US$203 million), offset by a change in impairment of trade and other receivables (US$61 million) and a decrease in other income (US$39 million), which represented fines paid by customers for overdue trade and other receivables; and savings on distribution and general and administrative costs (US$28 million and US$41 million, respectively). These factors were partly offset by weaker consolidated revenues, which decreased by US$553 million y-o-y to US$6,023 million in 1H 2014.

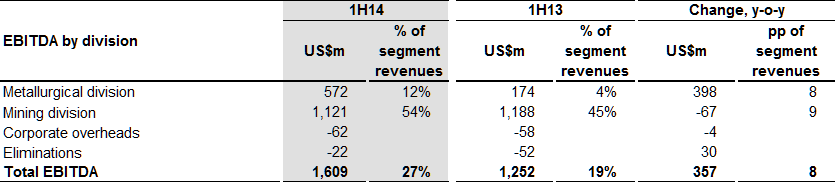

EBITDA

Adjusted EBITDA is calculated as earnings before income tax, financial income and costs, depreciation and amortisation, impairment and devaluation of property, plant and equipment, sponsorship and other charity payments, the share of results of associates and other non-core expenses. In 1H 2014, EBITDA increased by US$357 million y-o-y to US$1,609 million, while the EBITDA margin grew by 8 pp y-o-y to 27%. The absolute increase reflected the contribution from the Metallurgical division of US$398 million y-o-y, which was partly offset by the fall in the Mining division’s EBITDA of US$67 million, while a change in corporate overheads and eliminations contributed an additional US$26 million. In 1H 2014, the Metallurgical division’s EBITDA margin increased by 8 pp y-o-y to 12% and the Mining division’s by 9 pp y-o-y to 54%.

Finance income

Finance income comprises net foreign exchange gains, interest income on bank deposits and loans issued, imputed interest on other financial instruments, gains from early repayment of assets and other finance income. In 1H 2014, finance income totalled US$12 million, down US$16 million y-o-y. The decline was largely attributable to lower income from imputed interest on other financial instruments of US$7 million and lower interest income from loans issued by US$9 million compared with 1H 2013. As a percentage of consolidated revenues, finance income accounted for 0.2% in 1H 2014, down 2 pp y-o-y.

Finance costs

Finance costs include interest expenses on bank borrowings and debt securities, finance foreign exchange net losses, losses from the origination of financial assets and other finance costs. In 1H 2014, finance costs equalled US$417 million, up US$248 million y-o-y. The rise was largely attributable to higher net foreign exchange losses from intragroup loans denominated in US dollars. All other items that constitute finance expenses remained broadly unchanged y-o-y. As a percentage of consolidated revenues, finance costs totalled 7% in 1H 2014, up 4 pp y-o-y.

Share of result of associates and joint venture

In 1H 2014, the share of net income from associates and joint ventures increased by US$8 million y-o-y to US$23 million, largely due to the net profit generated by Zaporizhstal and Yenakiieve Coke Plant in the period.

Income tax expense

Income tax expense comprises current tax and deferred tax. Metinvest does not pay income tax on a consolidated basis, as the Group is subject to taxation in several jurisdictions, depending on the residence of its subsidiaries. In accordance with the Tax Code of Ukraine, the statutory corporate income tax rate is levied on taxable income less allowable expenses. It was 19% in 2013 and set at 18% for 2014. The difference between the effective and statutory tax rates is typically attributable to certain non-deductible expenses and/or non-taxable income as well as tax benefits that may be obtained in certain regions where Metinvest operates. The Group’s income tax rate derives from domestic tax rates applicable to profits from activities in its countries of operation in Ukraine, Europe and the US.

In 1H 2014, income tax expense increased by US$33 million y-o-y to US$168 million. Metinvest's effective tax rate, calculated as income tax expense divided by profit before income tax, was 20% in 1H 2014, down 3 pp y-o-y. The fall was due to a reduction in Ukraine’s income tax rate from 19% in 2013 to 18% in 2014; and the application of an 18% tax rate for unprofitable entities in 1H 2014, compared with 16% in 1H 2013, which resulted in less income tax.

Net profit

Net profit increased by US$207 million y-o-y to US$653 million in 1H 2014. This was due to a y-o-y rise of 70% in operating profit, which was partly offset by the abovementioned increases in finance costs and income tax. As a result, the net margin increased by 4 pp y-o-y to 11% in 1H 2014.

Consolidated cash flow

Net cash generated from operating activities

In 1H 2014, net cash from operating activities decreased by US123 million y-o-y to US$766 million. The principal reasons for the decrease was change in working capital which had a negative impact on the net cash flow in the amount of US$276 million and income tax paid and interest paid (US$226 million and US$117 million, respectively) in the six months ended 30 June 2014 compare to the positive impact of change in working capital (US$31 million) as well as lower income tax and interest paid (US$206 million and US$114 million, respectively) in the same period 2013. The change in working capital in 1H 2014 related to increases in inventories (US$59 million) and receivables (US$160 million) and decreases in accounts payable (US$56 million) and other non-current liabilities (US$1 million).

Net cash used in investing activities

In 1H 2014, net cash used in investing activities rose by US$38 million y-o-y to US$280 million. This increase was primarily attributable to a fall in proceeds from PPE due to the sale of assets within the Air Separation Unit project at Yenakiieve Steel (US$39 million); an increase in acquisition of associates due to investing in Black Iron (Cyprus) Limited in 1H 2014; income from loans issued to related parties and interest received (US$12 million); and a decrease in purchases of PPE due to changes in Metinvest's capital expenditure programme (US$11 million).

Net cash used in financing activities

In 1H 2014, net cash used in financing activities decreased by US$86 million y-o-y to US$710 million. This was primarily attributable to higher proceeds from loans and borrowings due to a loan from related parties of US$445 million in 2Q 2014; higher repayments of loans and borrowings totalling US$390 million in 1H 2014; repayments of trade lines (US$460 million); repayment of seller notes (US$45 million); and dividends paid (US$253 million).

As at 30 June 2014, net debt (loans, borrowings and seller notes less cash and cash equivalents) stood at US$3,335 million. This was 5% lower than the US$3,525 million as at 31 December 2013, and 2% lower than the US$3,400 million a year earlier.

As a result of the abovementioned factors, Metinvest’s cash balance stood at US$530 million as at 30 June 2014. This was 32% lower than the US$783 million as at 31 December 2013 and 41% higher than a year earlier.

Capital expenditure

Metinvest is implementing a strategic capital expenditure programme aimed at modernising its production facilities to increase their efficiency. Capital expenditure increased by 8% y-o-y to US$272 million in 1H 2014. The Metallurgical division accounted for 50% of capital expenditure (47% in 1H 2013) and the Mining division for 40% (45% in 1H 2013).

In 1H 2014, Metinvest continued implementing numerous investment projects in line with the Technological Strategy adopted in 2012 and updated in 2013. The 1H 2014 capital investment programme was less than budgeted due to financing constraints and limited access to external financing, as well as the rescheduling of some projects. The key investment projects are described below.

Metallurgical division

Major investment projects in 1H 2014 (some of which continue to date) included the construction of the PCI facilities at Yenakiieve Steel and Azovstal, the major overhaul of converter no. 1 and construction of a standby turbine air blower for the blast furnace nos. 3 and 5 at Yenakiieve Steel; preparations for fitting new filters to the existing sinter plant at Ilyich Steel; and the major overhaul of blast furnace no. 4 and replacement of a turbine air blower at Azovstal. In addition, Metinvest continued building the infrastructure for a new air separation unit (ASU) at Yenakiieve Steel.

Mining division

Metinvest continues to implement investment programmes at Northern GOK, Ingulets GOK and Central GOK. These include the development of deep-quarry crusher and conveyor technology and the construction of the required facilities at Northern GOK and Ingulets GOK. Other notable ongoing projects are the reconstruction of the pelletising machines (Lurgi 278-B, Lurgi 552-А, Lurgi 552-В) at Northern GOK.

- For editors:

METINVEST GROUP is a vertically integrated group of steel and mining companies that manages every link of the value chain, from mining and processing iron ore and coal to making and selling semi-finished and finished steel products. It comprises steel and mining production facilities located in Ukraine, Europe and the US, as well as a sales network covering all key global markets. The Group is structured into two operating divisions, Metallurgical and Mining, and its strategic vision is to become a leading vertically integrated steel producer in Europe, delivering sustainable growth and profitability resilient to business cycles and providing investors with returns above the industry benchmarks. For the six months ended 30 June 2014, the Group reported revenues of US$6.0 billion and an EBITDA margin of 27%.

The major shareholders of METINVEST B.V. (the holding company of Metinvest Group) are SCM (71.24%) and Smart Holding (23.76%), which partner in its management.

METINVEST HOLDING LLC is the management company of Metinvest Group.